Last Updated on September 4, 2025 by alli

Teaching young girls good money habits early will give them tools they can use for life. These skills will help them grow up feeling confident, capable, and independent.

For me, it’s important that my daughter grows up with a healthy relationship with money. I don’t want it to become a source of stress for her in the future. That’s why I’m teaching her how to budget, save, spend wisely, and set financial goals – skills that lead to financial independence.

The truth is, when a woman of any age can say she’s financially independent, that’s something to be proud of!

3 simple ways to start teaching money

1. Start early

It’s never too soon to start teaching your daughter about money. This includes helpling her understand how it’s earned and how it’s used in everyday life.

It can be as simple as saying, “Mum (or Dad) goes to work to earn money. With that money we buy food, clothes, books, and toys.”

Everyday situations are perfect teaching opportunities. Shopping, paying bills, or even receiving an electricity bill can show her that things like lights and heating don’t just appear — they cost money, which someone worked hard to pay for.

It’s also important to explain that everything she owns was bought with money, and that money represents effort.

My daughter went through a stage where she didn’t appreciate what she had. If she lost or broke something, she’d shrug and say, “Doesn’t matter, we’ll just get another one.” To help her understand value, we stopped replacing things straight away. She needed to see that every item has worth, and that it’s important to care for and appreciate what she already has.

2. Give an Allowance

An allowance is a powerful way to teach kids about budgeting and saving. It helps them connect effort with reward, and gives them the satisfaction of earning their own money.

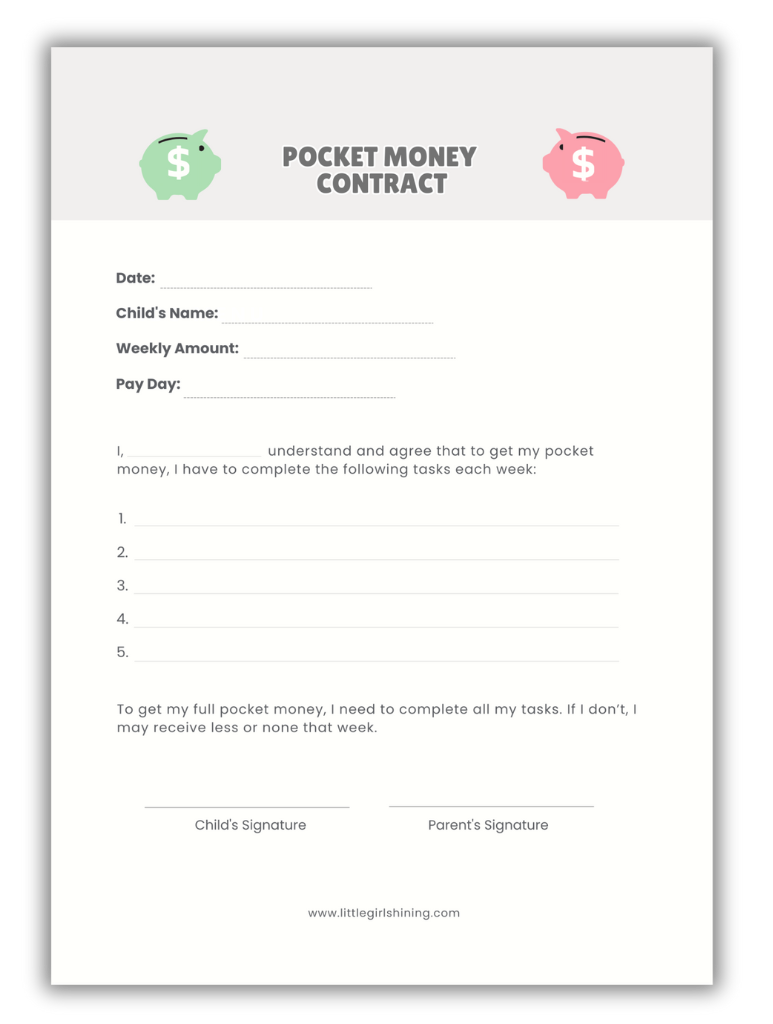

To make an allowance feel more “official”, and to encourage your daughter to take her responsibilities seriously, try using a simple contract. It sets clear expectations and makes the process more meaningful.

I’ve created one for you to help you get started.

Use my Free Pocket Money Contract!

The Pocket Money Contract is a simple way to set clear expectations for both you and your daughter. Here’s what it covers:

Payment amount

Decide on the weekly amount that works for your family. Some parents like to match it to age (e.g. a five-year-old receives $5, a six-year-old receives $6, and so on). Others prefer to set a flat amount. There’s no right or wrong, choose what feels right for your household.

Pay Day

Pick a day of the week to pay her, and stick to it. A regular “payday” gives her something to look forward to and helps her stay motivated.

List of tasks

Work with her to create a short, age-appropriate list of tasks she needs to complete each week in order to earn her allowance. For example, here are some of my daughter’s:

- Make my bed every morning.

- Set the dinner table every night.

- Empty the recycling bin when I see it’s full.

- Keep my room tidy.

- Do my homework after school each day.

Sometimes my daughter needs a little reminder to finish her tasks. All it takes is a quick countdown: “Three days until payday!” It works like a charm every time.

The Pocket Money Contract is part of the Money Management Pack that you can download for free below.

⬇️

3. Teach her how to set Savings Goals

One of the best ways to teach your daughter about saving is by helping her set clear, simple goals. When she can see what she’s saving for, it becomes fun and motivating.

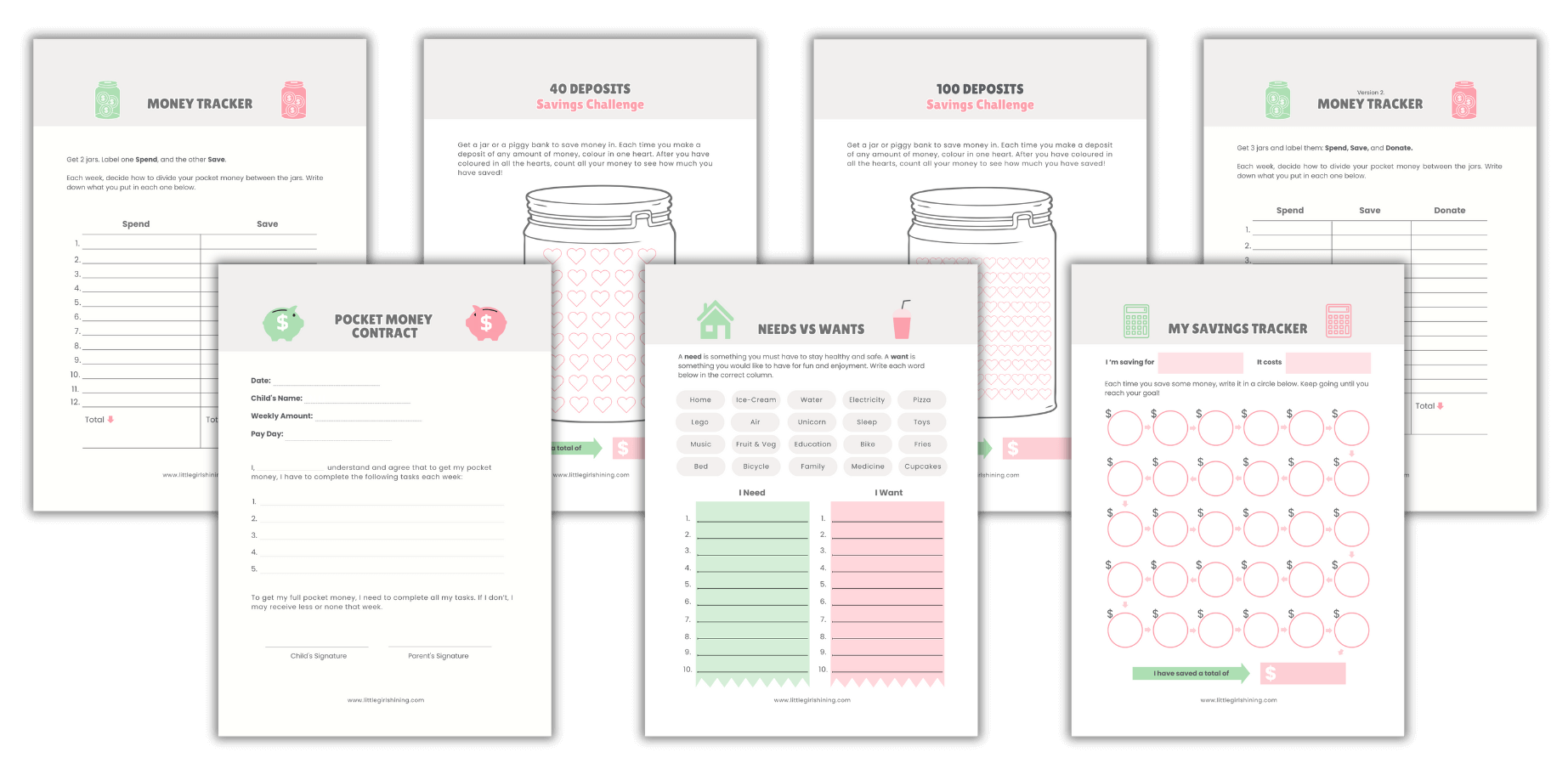

An easy way to do this is with money management sheets designed especially for kids. They make the process visual and enjoyable, while also showing her the steps of budgeting, saving, and tracking progress.

Free Download!

Money Management Sheets for Little Girls.

For more ‘girl mum’ topics, tips, and free resources, don’t forget to subscribe to Little Girl Shining. You’ll be joining a wonderful community of mums raising daughters! Alli x